NASA’s SCaN (Space Communications and Navigation) Program is committed to a seamless transition from government-owned communications assets to commercial alternatives. To accelerate this transition, the program is leveraging funded Space Act Agreements to support rapid design and demonstration efforts, while also giving industry the flexibility needed to lead this commercial transition. Through these partnerships, SCaN will ensure mission continuity, cost-effectiveness, and alignment with national priorities.

Expanding Near-Earth Access

As the agency’s satellite constellation nears retirement, future missions will partner with commercial industry to send and receive data in near-Earth orbit.

Learn More about Expanding Near-Earth Access

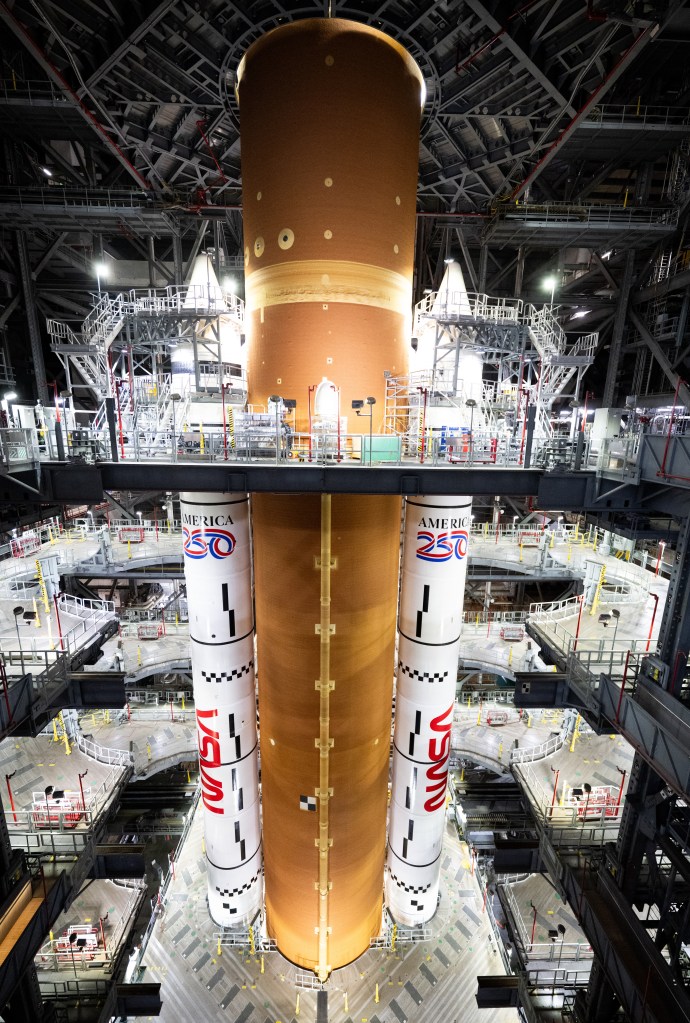

Boosting Satellite Capabilities

NASA is investing in the development of a variety of private satellite relay capabilities to boost data delivery for future missions through partnerships with multiple commercial companies. Learn more about NASA’s Communications Services Project.

Learn More about Boosting Satellite CapabilitiesGrowing Ground Support

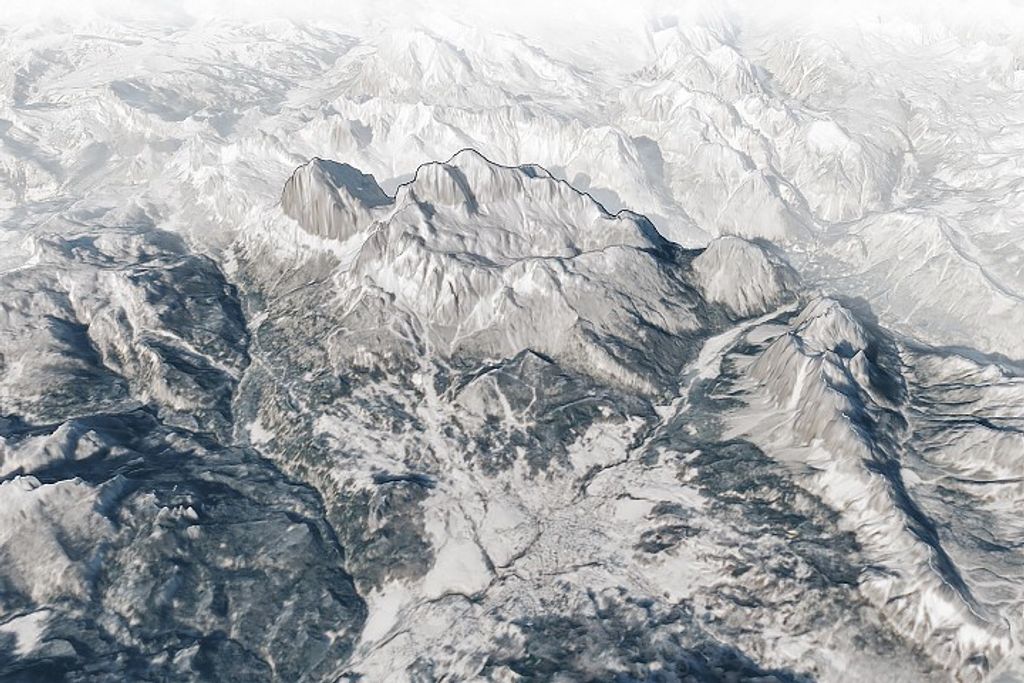

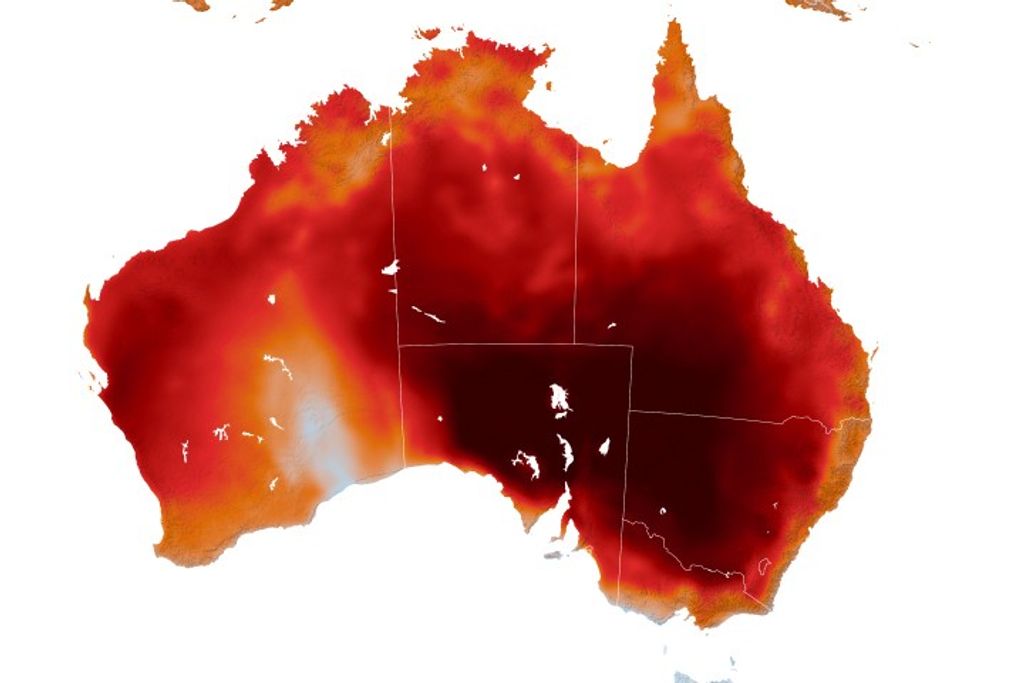

The Near Space Network uses satellites in space and antennas on Earth to support missions within 1.25 million miles of Earth. NASA is continuously partnering with industry to grow and diversify ground antennas, making the network stronger and more resilient.

Learn More about Growing Ground Support

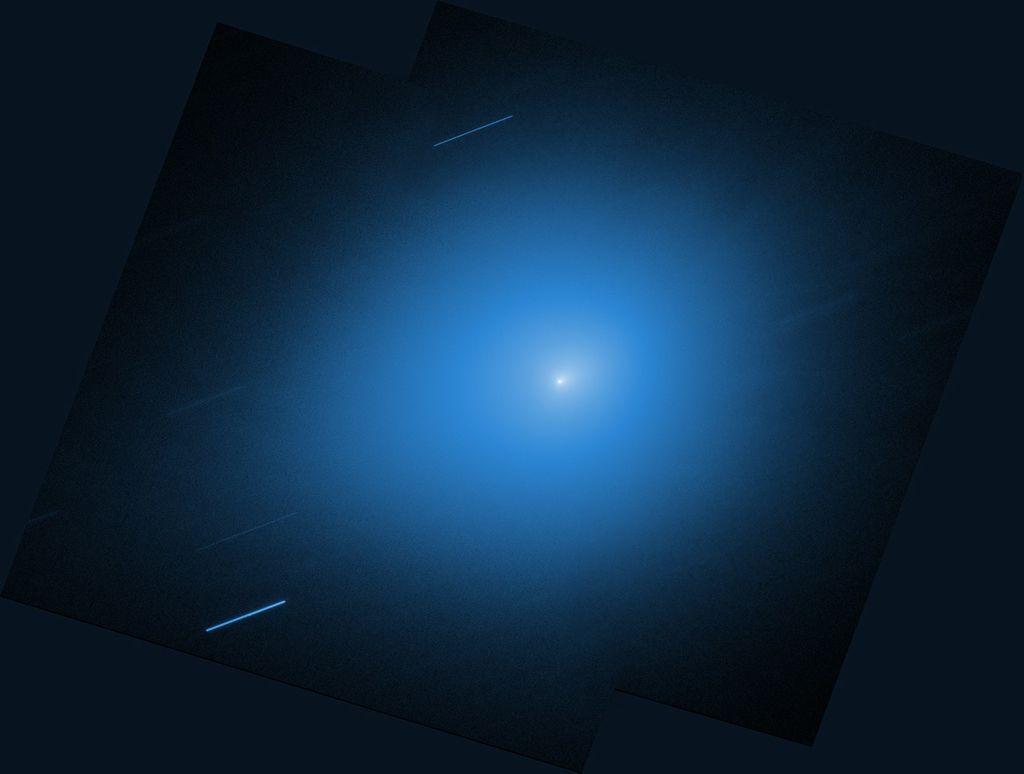

Fueling Next Generation Technology

NASA is advancing the future of space exploration through strategic partnerships that drive innovation and bring new technologies to life.

Learn More about Fueling Next Generation Technology

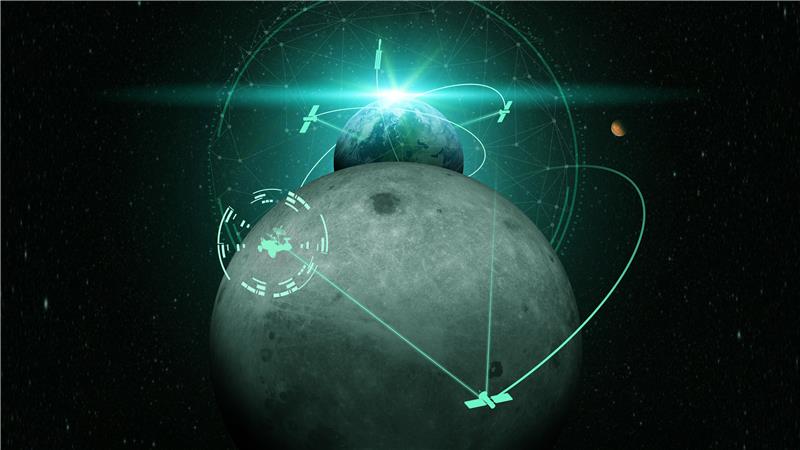

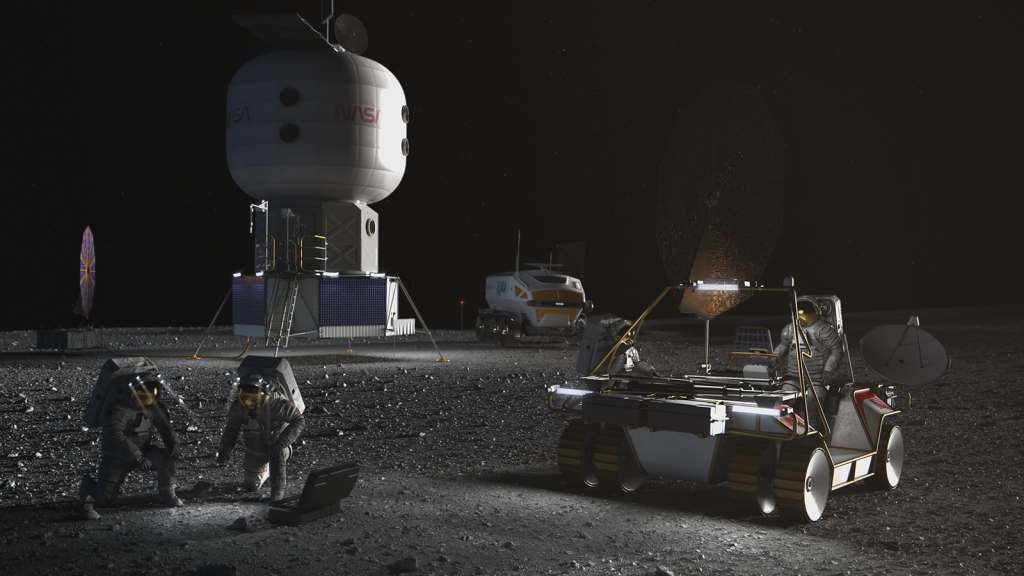

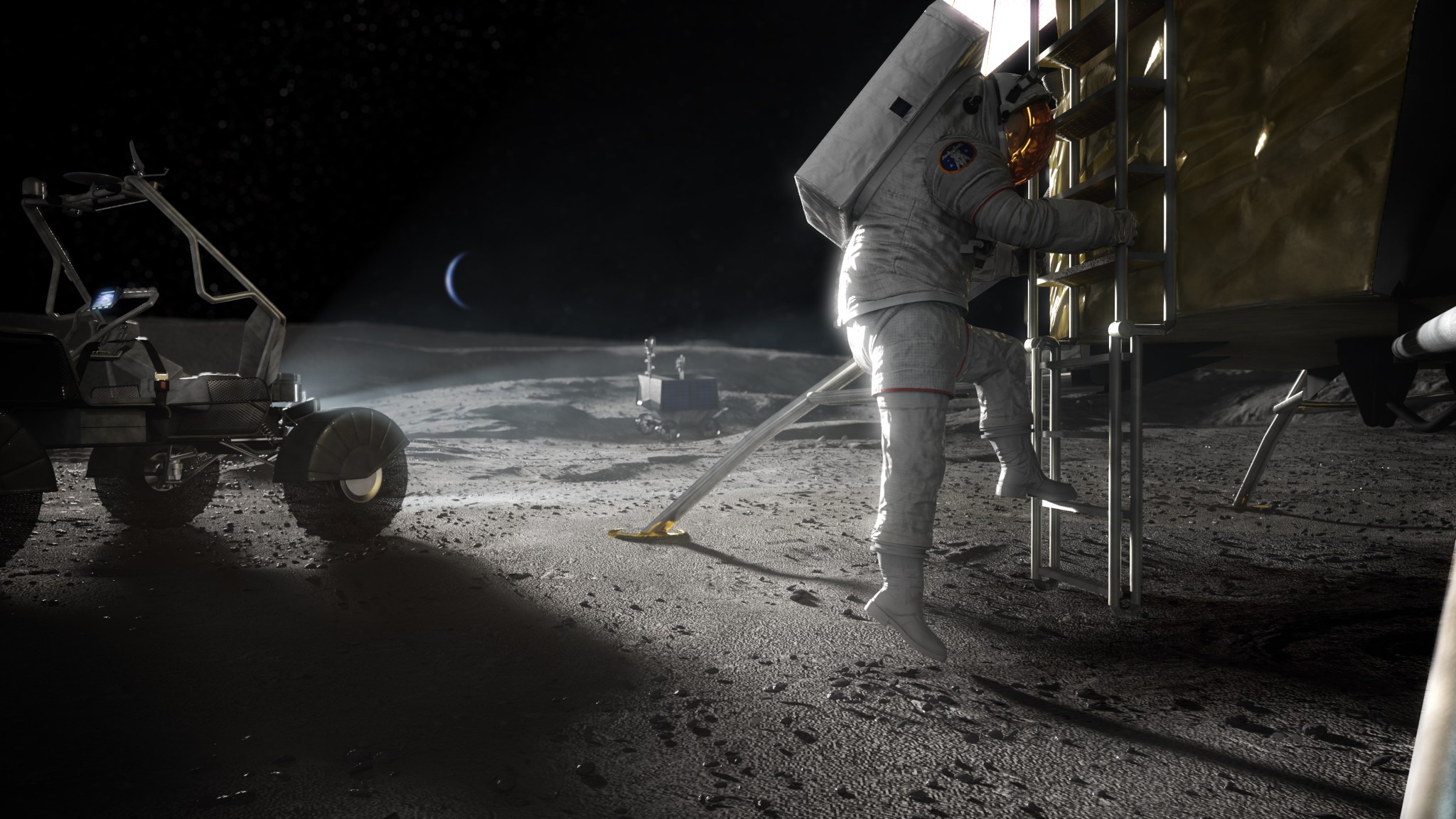

Empowering Relay Around the Moon

To build a sustainable presence around the Moon, NASA is working closely with industry to create the communications and navigation services that will keep astronauts and robotics safe and connected.

Learn More about Empowering Relay Around the MoonConnecting NASA to Industry

NASA’s Commercialization, Innovations, and Synergies office is connecting NASA with industry to advance the future of space exploration through strategic partnerships that accelerate innovation.

Learn More about Connecting NASA to Industry